Accountability

This is the time of year when a slight discomfort grips my thoughts. A stack of documents of all shapes and colors awaits to be classified, calculated. Although every year I tell myself that I will no longer be doing it again and that I will do the job as I go along, I invariably find myself in February spending three hours collecting the papers, diving into my accounting to prepare myself for taxes.

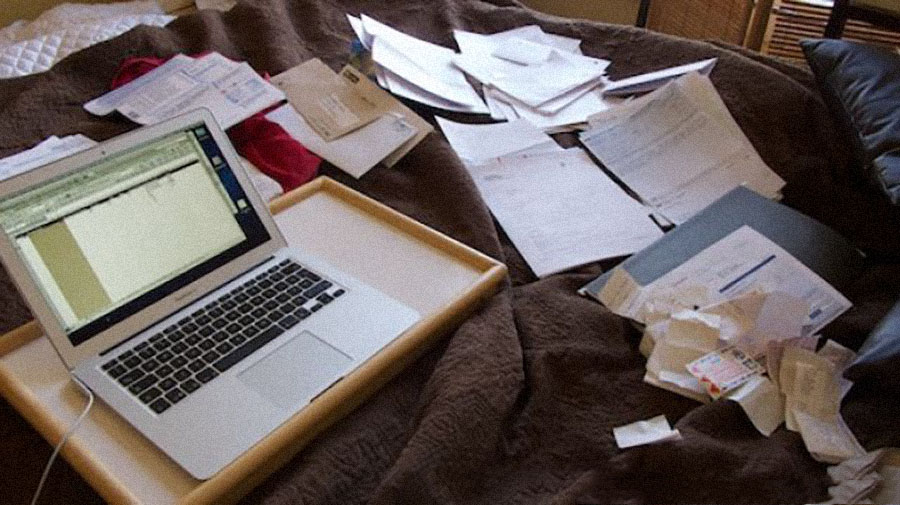

The picture says a lot. On the one hand, if there is an ordered universe, it is on my computer. On the other hand, the essential and low-rise paperwork, which, by an annual miracle, manages to get my full attention, have waited wisely for its time, between the slots of a full briefcase.

I’m not original in saying that I hate doing my taxes. Despite the simplicity of the exercise, I am a self-employed worker, and I must take into account the expenses of this, the revenues of that, mysterious calculations with all that, etc. Even if I use dedicated software, I feel like I’m going to make a mistake, that I’ll miss the deals and that, anyway, I’ll get screwed. I am in good faith, I seem to be doing the right thing since governments have been accepting my statements all this time... Why are taxes not made like in France where each citizen receives, when the time comes, a form already filled in?

I mind my own business, my accounts are paid, but it is clear that accounting and I do two. But I was different about ten years ago. That doesn’t matter. If I’m good at hammering and programming, I can certainly control my finances!

I will be told that we must budget. Well, so be it! I buy this software that runs beautifully and proclaims what it says: [You need a budget](http://www.youneedabudget.com/). A little rigor, Mr. Verville!

2019 PS: I failed completely.